owner's draw in quickbooks self employed

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Draws can happen at regular.

Owners Draw Account Quickbooks Setup Quickbooks Expense Management Chart Of Accounts

Fill out the other details of the cheque as youd like.

. Choose Lists Chart of Accounts or press CTRL A on your keyboard. Details To create an owners draw account. The owners draw is the distribution of funds from your equity account.

Say you open a company with your friend as equal partners each putting up. Select Print later if you want to. So your equity accounts could look like this.

Youre allowed to withdraw from your share of the businesss value through an owners draw. The draws do not include any kind of taxes including self. You have an owner you want to pay in QuickBooks Desktop.

Start Your Free Trial Today. Start Your Free Trial Today. Corporations if your business is formed as a c corporation or an s corporation you will most likely receive a paycheck just like.

Ad See How QuickBooks Saves You Time Money. First of all login to the QuickBooks account and go to Owners draw account. A draw lowers the owners equity in the business.

Make the cheque out to the owner. Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. Quickbooks Owner Draws Contributions - Youtube.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. An owners draw is an amount of money an owner takes out of a business usually by writing a check. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Draws can happen at regular intervals or when needed. The business owner takes funds out of the business for personal use. You can enter an opening balance for your owners draw account by editing the transaction causing the balance and changing it to the correct amount.

The Owners draw can be setup via charts of account option. Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. To write a check from an owners equity account.

As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the. An owner of a sole. Ad See How QuickBooks Saves You Time Money.

Click on the Banking and you need to select Write Cheques. To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click. Also you cannot deduct the owners draw as.

Setting Up an Owners Draw. Set up draw accounts. In QuickBooks Desktop software Select Lists menu option Further click on the Chart of Accounts from the.

The draw account is for tracking funds taken out use a different equity account for tracking funds in. June 1 2019 1210 AM If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you. Visit the Lists option from the main menu.

Choose the Owners DrawOwners Equity account in the Expenses section. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate. Choose the bank account where your money will be withdrawn.

This leads to a reduction in your total share in the business. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. To open an owners draw account follow the following steps.

In the window of write the cheques you. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

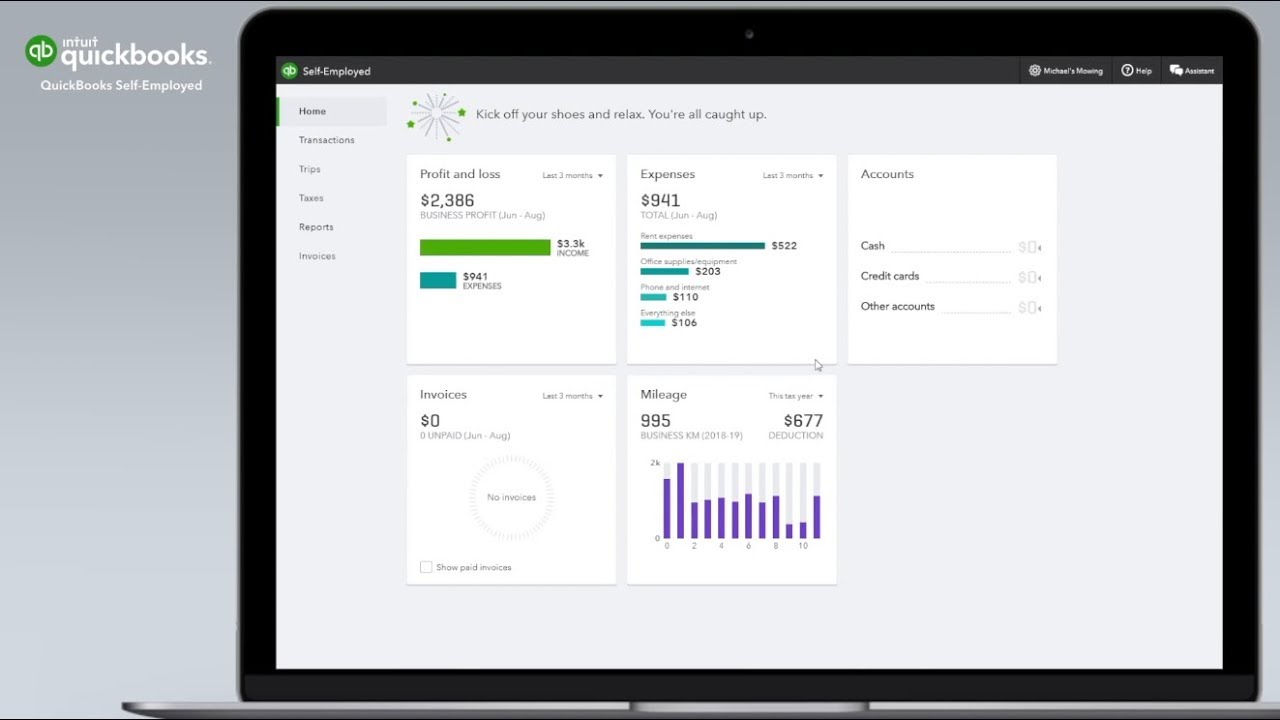

Quickbooks Self Employed Why I Went All In One Organized Business With Alaia Williams Quickbooks Business Organization Financial Planning For Couples

Quickbooks Premier Could Not Open Data File Error In 2021 Quickbooks Open Data Data

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Quickbooks Enterprise 5 Features For Receipt Management Quickbooks Management Enterprise

Quickbooks Self Employed Review Youtube

Quickbooks Self Employed App Explained 5 Minute Tutorial Youtube

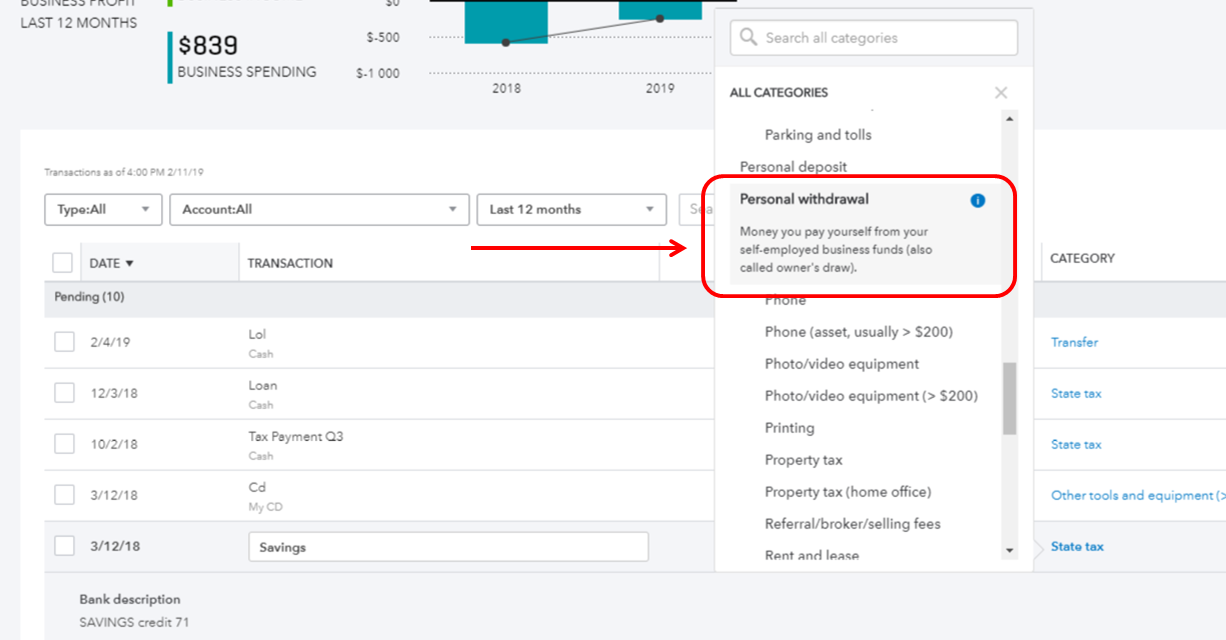

Solved Owner S Draw On Self Employed Qb

Quickbooks Self Employed Review 2022 Carefulcents Com Business Tax Small Business Bookkeeping Small Business Tax

Quickbooks Self Employed Complete Tutorial Youtube

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Own It Spring Equinox This Or That Questions Quickbooks

Freshbooks Review 2018 Try Cloud Accounting Software Free For 60 Days Careful Cents Freshbooks Accounting Software Small Business Accounting

What Is An Llc What Are The Advantages And Disadvantages If You Are Starting Up A New Business Selling Your Soc Business Finance Business Savvy Business Tips

Solved Owner S Draw On Self Employed Qb

Setup A Draw From Quickbooks Self Employed

Taking Self Employed Drawings How To Record Money Your Pay Yourself Using Quickbooks Online Youtube

How To Categorise Expenses W Quickbooks Self Employed On The Web Youtube

Keeping Up With All The Things How Intuit Quickbooks Self Employed Helps Me Track Prep For Tax Season Quickbooks Tax Season Keep Up